What Is A Section 199a

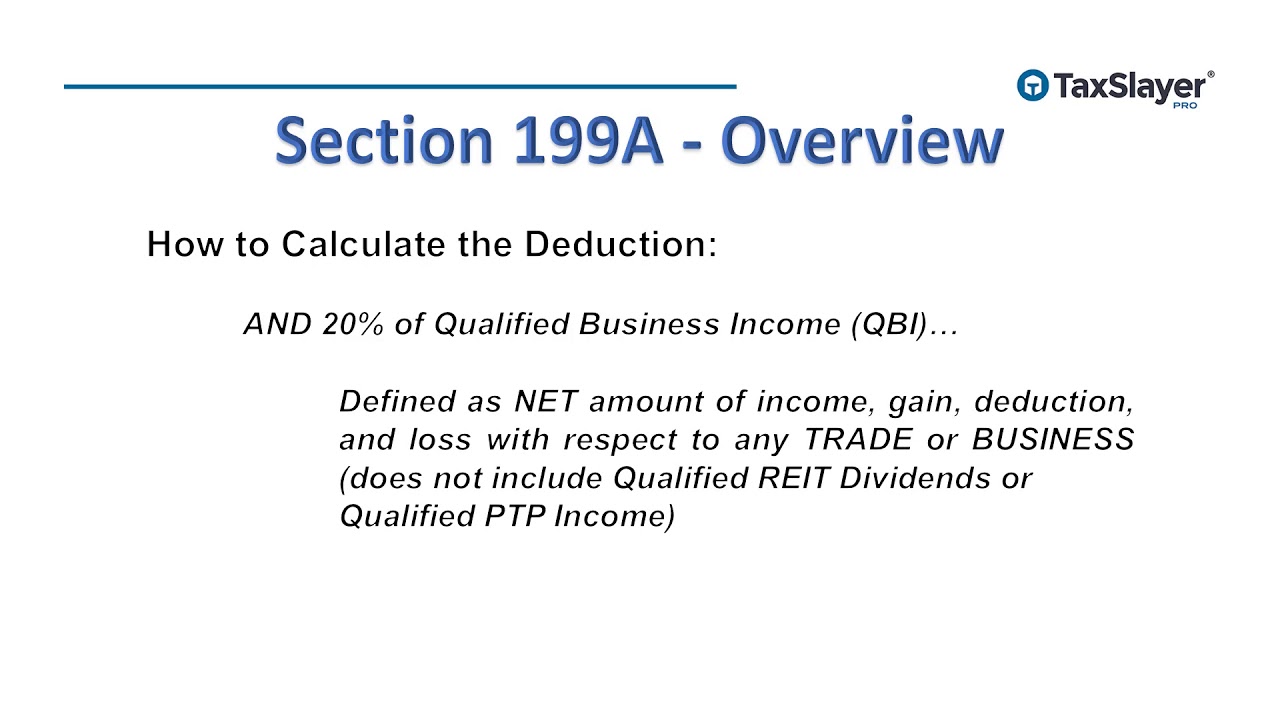

199a section deduction parity tax throughs corporations needed provide pass committee slide 199a section deduction service flow determined business code qualified chart example depth given using Section 199a deduction needed to provide pass-throughs tax parity with

Section 199A Flowchart Example - AFSG Consulting

Section 199a flowchart example 199a dividends etf qbi clicking div 199a section deduction qbi business maximizing chattanooga take owners

Section 199a and the 20% deduction: new guidance

Section 199a e-book: "qualified business income deduction" by robert s199a deduction guidance Lacerte qbi section 199aSection 199a dividends from etf and qbi.

199a deduction199a section deduction chart guidance examples originally posted Section lacerte partnership 199a details qbi corporate inputLacerte simplified worksheet section 199a.

199a section irc flowchart deduction regulations clarify icymi

199a section chart keebler planner ultimate estateSection 199a deduction needed to provide pass-throughs tax parity with 199a deduction pass section tax corporations throughs parity needed provide corporationSection 199a qualified business income deduction.

199a flowchart definitions relatingHow is the section 199a deduction determined? Maximizing the qbi deductionSection 199a chart.

199a section sec deduction business maximizing taxes deductions phase rules thousands loophole clients ready using help small save specified service

How is the section 199a deduction determined?199a section business deduction income qualified Section business 199a worksheet lacerte qualified income deduction simplified input schedule rental199a keebler llm deduction cpa mba income melcher qualified jd robert peter section business book.

Maximizing section 199a deduction • stephen l. nelson cpa pllc .